Investing In Precious Metals And Commodities

Table of Contents

When we talk about investments, people often think about the stock market or, perhaps more recently, the cryptocurrency market. However, if you dive in deep or have been in the investment game for quite some time, you are probably already aware of how volatile the market is.

Hence, you tend to look for more stable investments than the stock market or cryptocurrency.

Here are some of the things you need to know about investing in precious metals and commodities

Commodities Investment

This type of investment deals with commodities or goods you can invest in, which can later be transformed into other articles of trade or services. So by this logic, precious metals investments also come under commodity investments.

If you look at the history of commodity investments, it can date back to centuries when barter systems were prevalent. This meant that before terms like bonds and stocks weren’t even in their vocabulary, people used commodities like textiles to exchange for other required raw materials or services.

How To Invest In Commodities:

- Buying commodities like precious metals (Gold, Silver, Platinum)

- Trading in commodity futures

- Buying ETFs funds and commodities

- Buying shares in commodity-based companies (Examples: agriculture, timber, oil, and gas)

- Getting into commodity-based investment trusts and funds

Advantages:

- It acts as a hedge against inflation rates, so it protects you from the rising prices in the market

- Diversifies your portfolio

- Good returns

- Lower trading margin in comparison with bonds and stocks

Disadvantages:

- Some commodities are more volatile than others, so you are more exposed to risks.

- Commodities can be affected by weather conditions and climate

- It can be speculative; there are no underlying cash flows because profits are based on market prices.

- It can be affected by political issues like war.

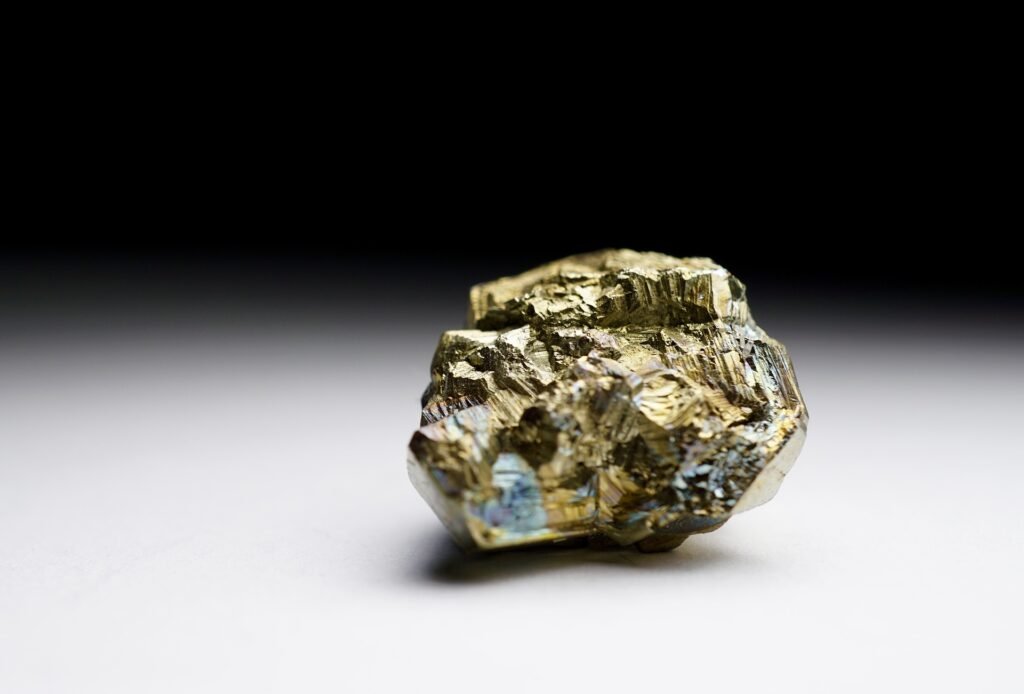

Precious Metal Investment

Gold:

One might say gold is among the most common and investable metals among all precious metals. It has its own perks, such as physical properties like its durability and malleability, and the popularity it enjoys as a base for beautiful jewelry, especially as a form of currency.

Unlike other commodities, the value of gold is not defined or restricted by the laws of demand and supply. Instead, its value changes as per the market 24×7.

Why Invest?

Investors like to put all their faith in this yellow and shiny metal due to its unquestionable value regardless of the instability of banks, inflation in the market, and even in the event of a crisis like a world war or a political catastrophe.

How To Invest:

- Buying physical gold bars, coins, and jewelry

- Exchange Traded Funds (ETFs), which are gold focused

- Mutual funds focusing on gold

- Purchasing gold stocks and shares in gold streaming, mining, or royalty companies

Silver:

Silver is a close second on the value scale regarding precious metals. Silver is used as an industrial metal in many industries. Hence, silver is more volatile when compared with gold in the precious metals market.

Why Invest?

The full disclosure is that the value of silver fluctuates with the market demand for its use in several industries. For example, silver was once in high demand in the photography industry when developing silver-based photographic film. Still, this dominance has been hindered since the advent of digital cameras.

With the rise in the demand for electrical appliances that use silver, the market is in a good place for silver investors. So just like in the case of gold, the price of silver will increase when the total reserve is low and vice versa.

How To Invest:

- Buying physical silver coins or bullion

- Getting silver futures

- Exchange Traded Funds (ETFs), which are silver focused or that own silver miners

- Buying silver mining stocks

Platinum:

Platinum is not as common as silver and gold but still share a good market value among precious metals. Platinum is quite rare, which is why sometimes it can outweigh gold’s value simply due to its rarity.

It is also like silver in its properties which is why it is used in many industries. This means that the value of platinum can also increase or decrease depending on the demands of the industries.

Bottom Line

Due to their stability and ability to be exchanged for services or other goods, commodities and precious metals are attractive investments to many investors.

The only real danger is the unpredictable nature of the market, but most investors are ready to accept the risk. These types of investments tend to be appealing since they can diversify investors’ portfolios.

FAQ

What are precious metals and commodities?

Precious metals are rare and valuable metals, such as gold, silver, platinum, and palladium. Commodities are raw materials or primary agricultural products that are traded on exchanges, such as crude oil, natural gas, copper, corn, and wheat.

Why should I invest in precious metals and commodities?

Precious metals and commodities can provide a hedge against inflation, diversify your investment portfolio, and offer potential capital appreciation. They also have industrial uses, making them valuable in a variety of sectors.

How do I invest in precious metals and commodities?

There are several ways to invest in precious metals and commodities, including buying physical metals or commodity futures contracts, investing in exchange-traded funds (ETFs) that track the price of metals or commodities, or investing in mining or energy stocks.

What are the risks of investing in precious metals and commodities?

The prices of precious metals and commodities can be volatile and affected by geopolitical events, supply and demand factors, and currency fluctuations. There is also the risk of fraud when buying physical metals or investing in mining or energy stocks.

Should I invest in physical precious metals or ETFs?

It depends on your investment goals and risk tolerance. Physical metals provide tangible assets that you can store and access directly, but they also require secure storage and may have higher transaction costs. ETFs offer more liquidity and lower transaction costs, but they do not provide direct ownership of the underlying assets.